Transaction Support

Consark plays a pivotal and indispensable role in due diligences, transaction support, and earn outs, helping clients navigate the complexities of mergers, acquisitions, and other critical business transactions. In due diligences, our expert team conducts comprehensive assessments of target companies, meticulously analyzing their financials, operations, and risks to uncover crucial insights. Armed with this information, our clients can make well-informed decisions and negotiate from a position of strength. As a trusted transaction support partner, Consark provides strategic guidance and advisory services throughout the deal process, ensuring seamless execution and optimal outcomes for our clients.

Additionally, our proficiency in structuring earn outs—a mechanism used to bridge valuation gaps and align interests between buyers and sellers—ensures that contingent payments are well-designed and contingent events are clearly defined, fostering a smoother integration of acquired entities. Through our diligent and methodical approach, we help clients mitigate risks, identify opportunities, and maximize value creation. Our expertise and commitment to excellence have earned us a reputation as a reliable and results-driven partner in the world of business transactions. Consark’s contributions extend beyond mere valuations, as we actively contribute to our clients’ success stories by facilitating well-informed, strategic, and financially sound decisions.

Due Diligence & Deal Support

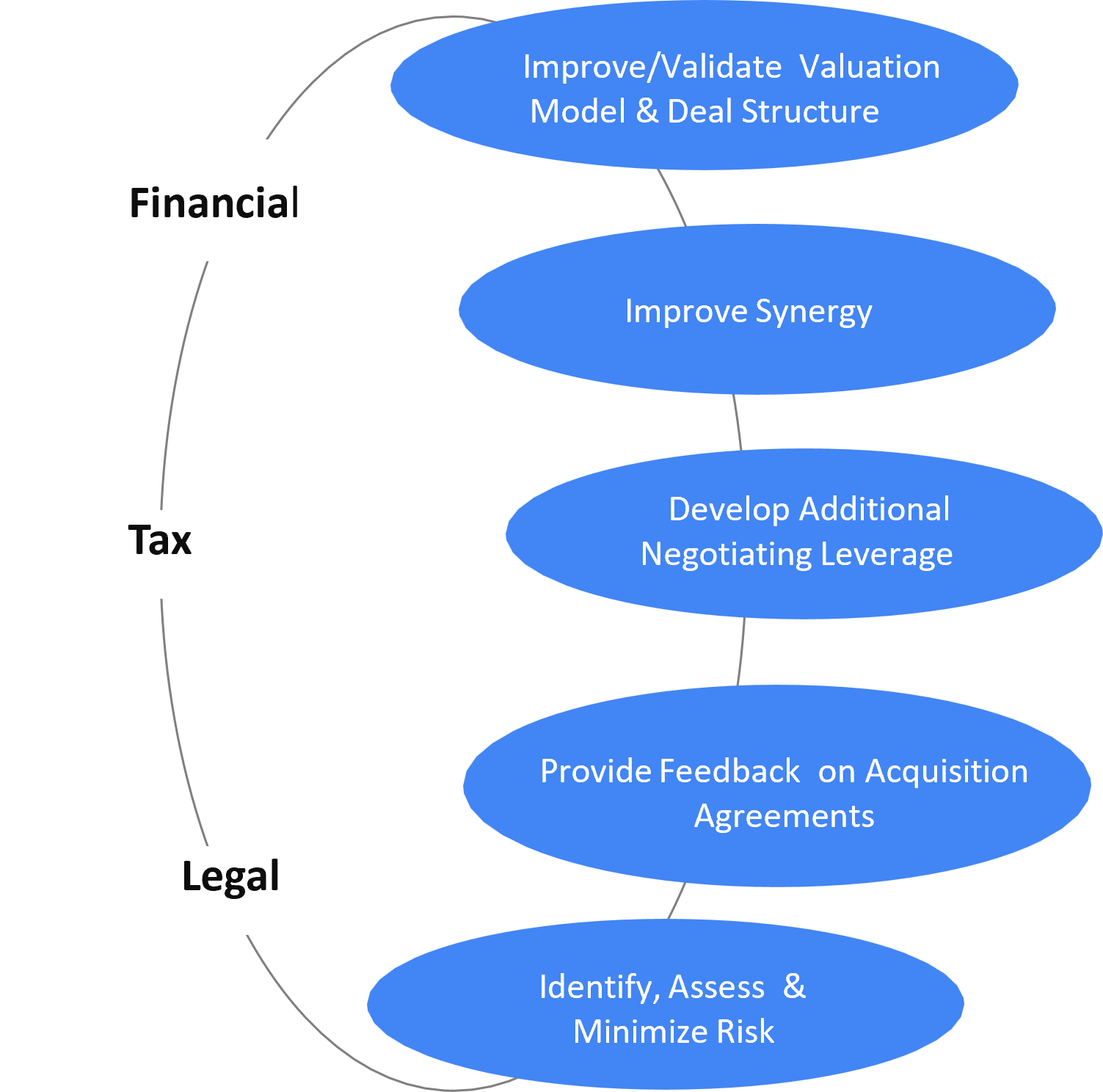

Our approach

Our experience shows that it takes a well organized and executed, multidisciplinary approach to a successful management of due diligence process, focused on validating value proposition assumptions, understanding risks and providing actionable feedback

- We aim to support companies evaluating strategic opportunities

- Funds – PE/VC in their investments

- Pre-Funding Diligence Support for companies raising capital

- Overseas investment diligence support with our network partners

Due Diligence & Deal Support – Select Transactions